How To Get Value For Your Third Party Insurance

The typical Nigerian buys third party auto insurance simply because they are required to buy it. The third party insurance is supposed to cover the cost of repairs when you damage someone’s car or property. However, most people usually do not make claims when involved in accidents. They end up paying for the damage, meaning that Nigerian drivers are not getting value for their third party insurance.

The average Nigerian driver pays about N5,000 for third party car insurance. By not using it, they are giving free money to the insurance companies. This leaves Nigerian drivers feeling exasperated, and seemingly having no one to turn to. But there is hope, there are ways to ensure that you get value for your third party insurance.

Buy your Insurance Yourself

One of the biggest mistake we make is not buying our car insurance ourselves. Most of us use agents or our drivers to register our new car or renew our old cars. We should be taking out time to buy our insurance ourselves to ensure we get genuine insurance.

Pull out your current insurance policy right now and see if it is with one of the registered members of the Nigerian insurance association(NIA). Buying your insurance from one of them gives you recourse when they fail to pay (more on this later).

Some of these agents give you fake or unreliable insurance companies. This is the primary reason you are not able to get value for the third party insurance you pay for. So, the next time you want to register or renew your car, call one of the registered members of the NIA to ensure you get a reliable and genuine insurance coverage. Then, you can tell the agent or your driver to renew the car without insurance since you already bought one.

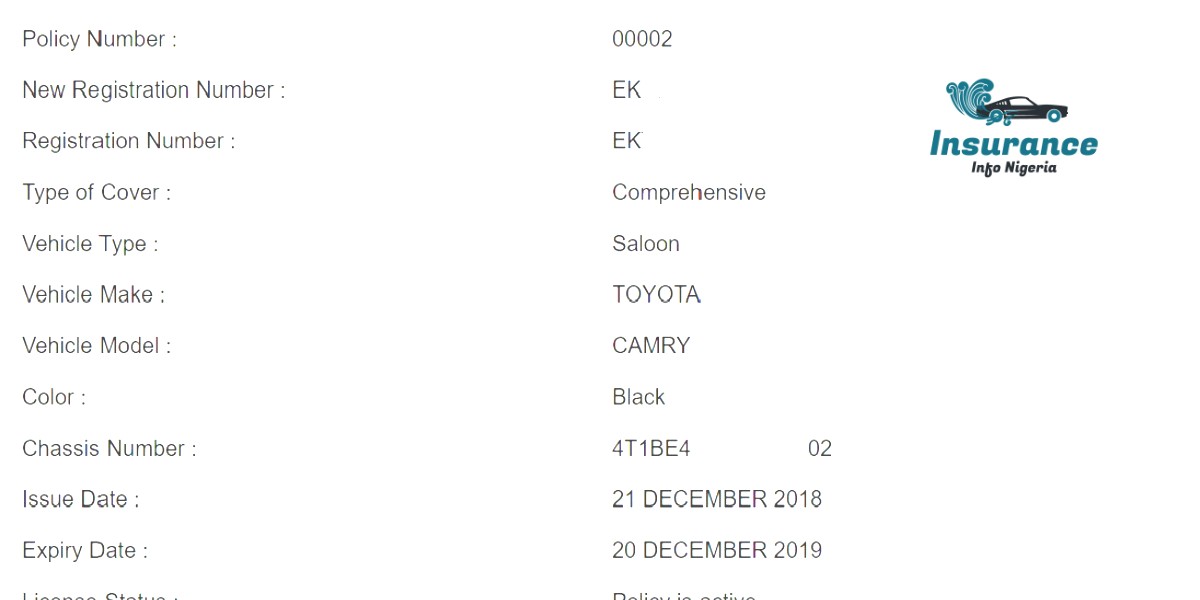

Verify that the insurance you bought is real

Fake car insurance became so rampant that the government came up with a database with information of all valid insurance policies. This is very useful for Nigerians to confirm that the insurance policy they have in their vehicle is genuine. All you have to do is visit the website, go to check policy and search either by your registration (license plate number) or your policy number. If the information exists, it will display your car and insurance information. If you get no result, it means you do not have a valid insurance.

You can also check the status of your insurance by dialing *565*11# on any phone and following the prompt. This is particularly handy for those without internet access.

How to make a claim

By now, you should know that third party insurance only covers the car of the person you hit if you are at fault. You would need comprehensive insurance to cover your car and the car of the other person. Should you be at fault in an accident, don’t panic, after all, you are insured.

You need to give the other party your information such as driver license number, registration number, car insurance policy info. You would have to sign an undertaken agreeing to your fault in the accident. Then call your insurance agent (you should have his number handy since you bought your insurance yourself) and let him/her know what happened. Then follow up with the insurance company to ensure they pay for the damages.

If you are the victim in the car accident and you have comprehensive insurance, get all the aforementioned detail from the person that damaged your car, and provide it to your insurance company so they can recover the cost of fixing your car from the other insurance company.

What if the insurance company refuses to pay

We talked about making sure you are using one of the registered members of the NIA. This is because it is the umbrella organization for all insurance companies in Nigeria. They are able to call their members to order. If the insurance company refuses to pay for the damage to another vehicle despite having genuine insurance, then you can make a complaint to them by either calling or texting 0817 078 4444 or 0802 990 8531.

You can also send an email to them at info@nigerianinsurers.org and copy the Nigerian insurance industry database at support@niid.org to ensure that the insurance company is compelled to comply. They run the risk of losing their insurance license if they don’t comply.

Do you have questions about car insurance or need guidance on how to go about making successful insurance claims? Do you have any question you would like us to answer? Send them to Insurance Info and please include the state where you live (no full names will be used).

By submitting your story to Insurance Info Nigeria, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Related

About The Author

JPeezy

Related

Related Posts

What Comprehensive Insurance Is Best?

Dear Insurance Info, I drive a Toyota Camry LE 2010. So please what type of…

Related

Health Insurance Is Beneficial, You need One Now

Today I want to take out time to write about why health insurance is beneficial…

Leave A Comment